A database of WGAW members that helps employers find a writer by providing a searchable directory with contact information.

Paid Parental Leave

This benefit is available to Health Fund participants who work under the MBA or other agreements.

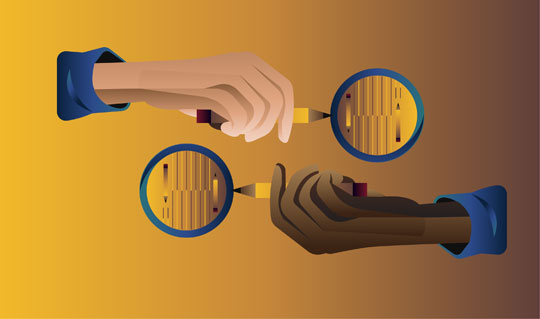

Project Page

A tool to help screenwriters be more informed at the initial point of contact on feature projects.